san fran sales tax rate

This includes the rates on the state county city and special levels. This is the sum of the sales tax rates in the state county and city.

California Sales Tax Rate Changes January 2013 Avalara

2020 rates included for use while preparing your income tax.

. Assessed at 748000 the tax amount paid for 1075 Market Street 606 San Francisco CA 94103 is 8845. What is the sales tax rate in San Francisco California. The latest sales tax rate for San Francisco CA.

Average Sales Tax With Local. The City currently imposes a 25 tax on total parking charges for all off-street parking throughout the City. This is the total of state county and city sales tax rates.

See reviews photos directions phone numbers and more for Sales Tax Rate locations in San Francisco CA. This rate includes any state county city and local sales taxes. California has state sales tax.

Parking Operators file and pay taxes monthly and have additional requirements. The minimum combined sales tax rate for San Francisco California is 85. For a more detailed breakdown.

The Office of the Treasurer Tax Collector is open from 8 am. 2022 List of California Local Sales Tax Rates. Until 2018 all businesses with a taxable San Francisco payroll expense greater than 150000 must file a Payroll Expense Tax Statement for their business.

Walk-ins for assistance accepted until 4 pm. Choose city or other locality from San Francisco. This is the total of state county and city sales tax rates.

The South San Francisco California sales tax is 750 the same as the California state sales tax. The base sales tax in California is 725. This rate includes any state county city and local sales taxes.

The San Francisco County California sales tax is 850 consisting of 600 California state sales tax and 250 San Francisco County local sales taxesThe local sales tax consists of a 025. The minimum combined 2022 sales tax rate for South San Francisco California is. San Francisco Californias minimal combined sales tax rate for 2020 is 85 percent.

This is the total of state county and city sales. You can also use Sales Tax calculator at the front page where you can fill in percentages by yourself. This rate includes any state county city and local sales taxes.

2020 rates included for use while preparing your income tax. The minimum combined 2022 sales tax rate for San Francisco California is. 1788 rows California City County Sales Use Tax Rates effective October 1 2022 These rates may be outdated.

City Hall Office Hours. Lowest sales tax NA Highest sales tax 1075 California Sales Tax. How much is sales tax in San Francisco.

Monday through Friday in room 140. For a list of your current and historical rates go to the. The California sales tax rate is currently 6.

While many other states allow counties and other localities to collect a local option sales tax. Payroll Expense Tax. The 8625 sales tax rate in San Francisco consists of 6 California state sales tax 025 San Francisco County sales tax and 2375.

2020 rates included for use while preparing your income tax. The average cumulative sales tax rate in San Francisco California is 864. When was 1075 Market Street 606 San Francisco CA 94103 last sold and.

The latest sales tax rate for San Francisco County CA. 0875 lower than the maximum sales tax in CA. What is the sales tax rate in South San Francisco California.

This is the total of state county and city sales tax rates. The current sales tax rate in. The minimum combined sales tax rate for San Francisco California is 85.

The latest sales tax rate for South San Francisco CA.

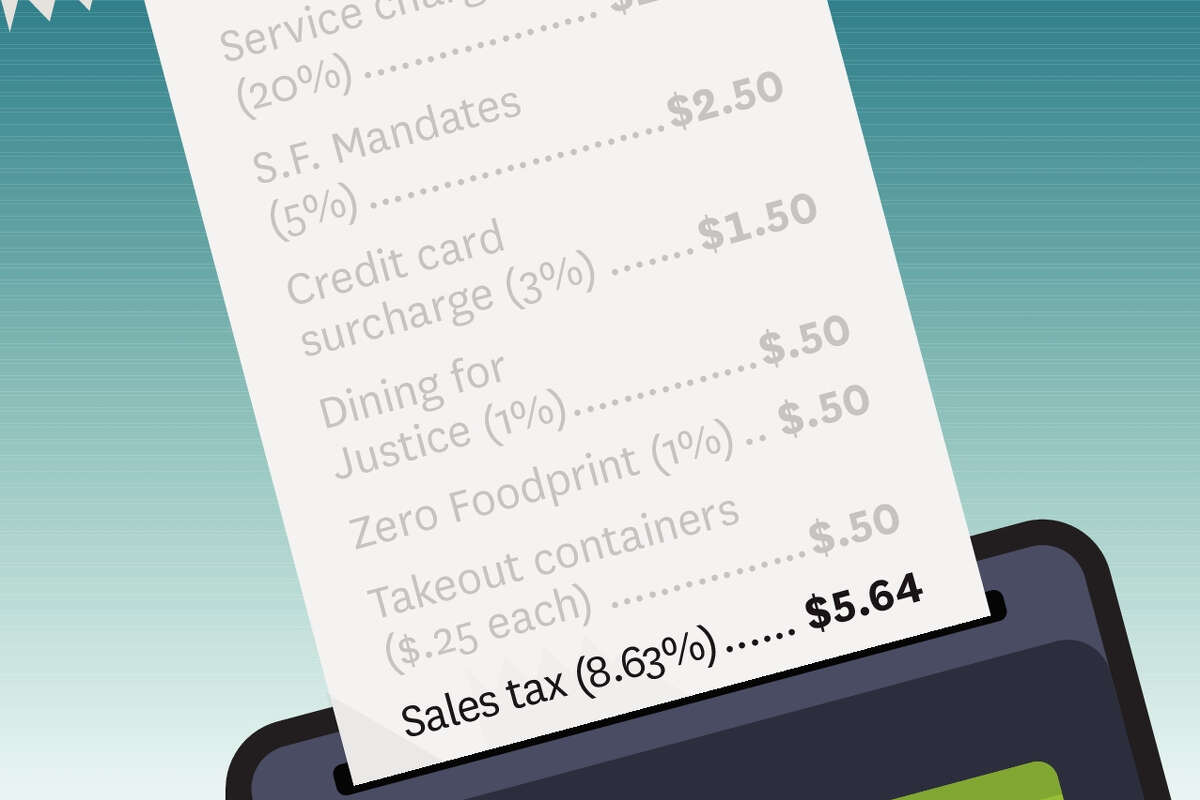

Did You Pay Way More At A Restaurant Than You Expected Here S How Bay Area Surcharges Work

Sales Tax Analyst Resume Samples Velvet Jobs

What You Should Know About Sales And Use Tax Exemption Certificates Marcum Llp Accountants And Advisors

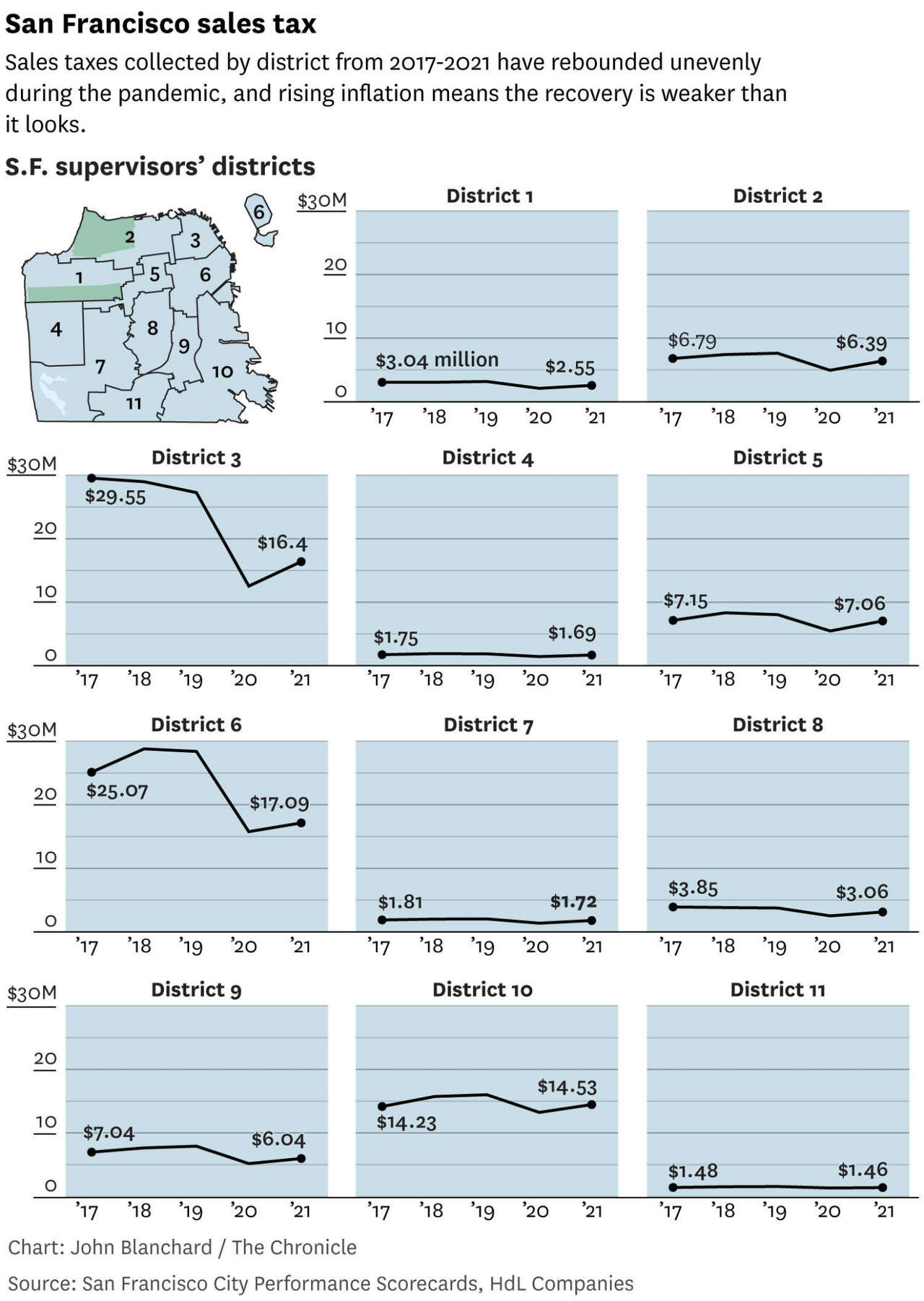

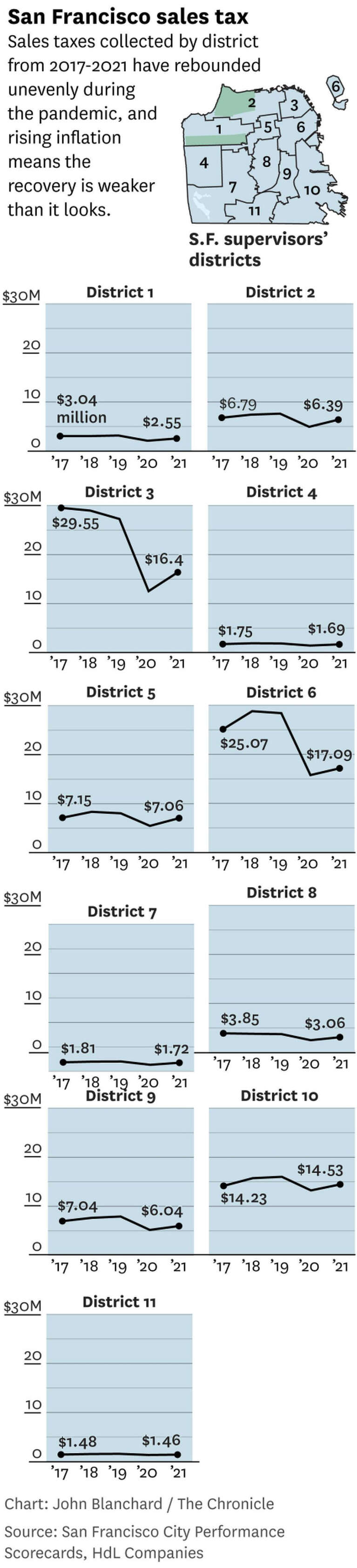

Downtown Vs Neighborhoods S F Sales Tax Data Shows Where People Are Spending Their Money

San Francisco Property Taxes Kevin Jonathan Top San Francisco Real Estate Kevin K Ho Esq Jonathan Mcnarry Vanguard Properties 415 297 7462 415 215 4393

What S This S F Mandates Surcharge Doing On My Restaurant Check An Explainer

California Sales And Use Tax Exemption Kbf Cpas

California Sales Tax Calculator And Local Rates 2021 Wise

Why Households Need 300 000 To Live A Middle Class Lifestyle

Tax Guide Best City To Buy Legal Weed In California Leafly

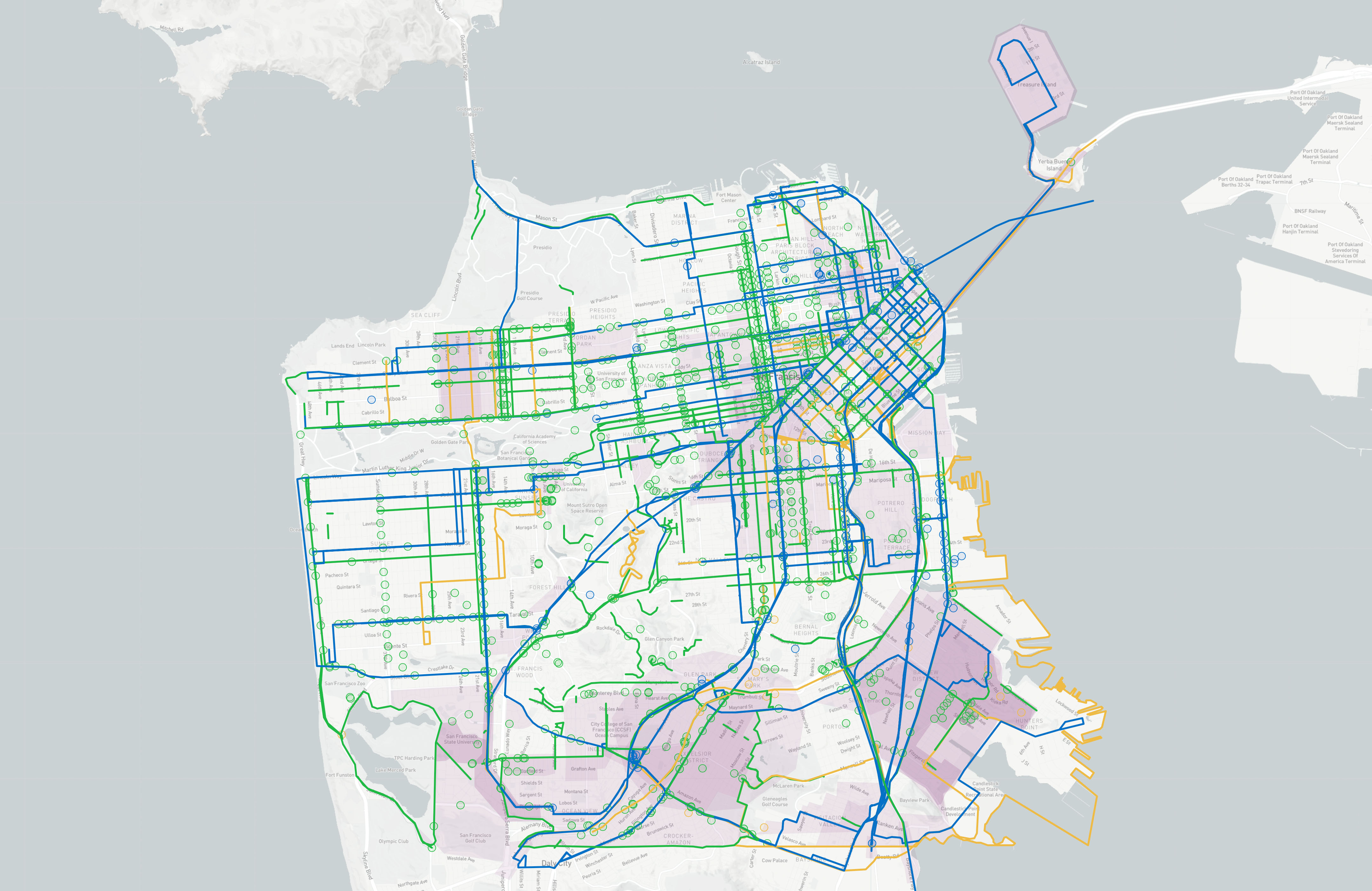

San Francisco Prop K Sales Tax For Transportation And Homelessness Spur

House Prices In San Francisco Bay Area Experience Steep Declines From April Peak Craziness Down Year Over Year Wolf Street

2022 Transportation Expenditure Plan Sfcta

State And Local Sales Tax Rates Sales Taxes Tax Foundation

Downtown Vs Neighborhoods S F Sales Tax Data Shows Where People Are Spending Their Money

San Francisco Prop W Transfer Tax Spur

How Much Is Weed Tax In San Francisco Lajolla Com

San Francisco Prop K Sales Tax For Transportation And Homelessness Spur